Table of Contents

Simplifying health insurance processes through an app has become a necessity, especially since we have all grown accustomed to it. We expect an app for almost everything, and insurance is no exception, but there is a lot it can help users with aside from offering convenience.

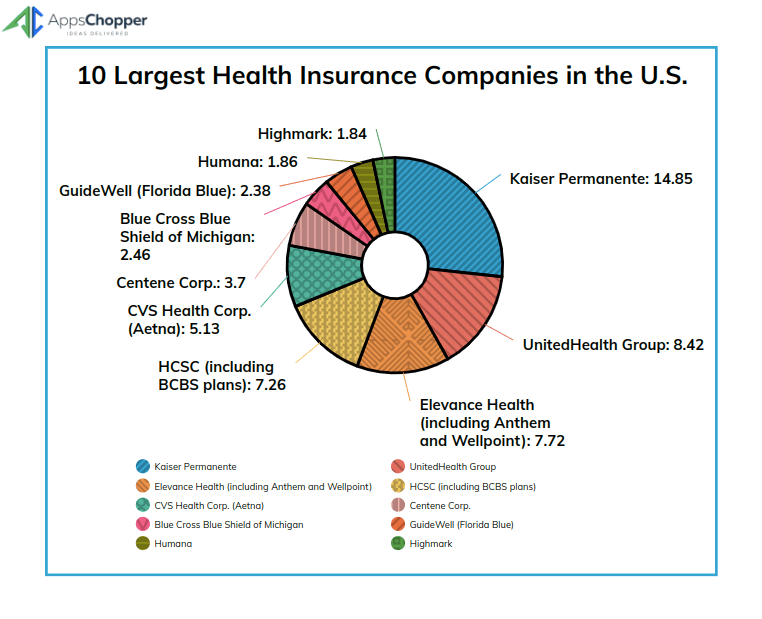

Whether you own a health insurance company or wish to work in conjunction with such organizations, investing in health insurance app development is the right move. Insurance is a huge market with millions of customers, and it is expected to cross 3 trillion US dollars by 2028.

As with all investments, however, it pays to know everything you possibly can about building such an app before you begin.

Why is Health Insurance App Development Necessary in Today’s Scenario?

As of 2024, there are approximately seven billion smartphone users in the world. The development of health insurance apps brings healthcare access to their devices, overcoming the accessibility problems insurance holders faced previously.

Cut Through Paperwork

A healthcare insurance app eliminates a great deal of paperwork that the process of applying for one is notorious for. Users can fill in all the documents needed online. This means they will not have to wait for hours in long queues, either. In short, your app will provide users with a convenient means to get insurance and receive coverage.

Simplify Policy Selection

Everyone is different, which means their insurance needs will differ as well. A health and life insurance app often has features to help users find the most suitable plan according to their needs. It is extremely convenient, enabling users to do everything they needed to ask an agent to handle before. This includes tasks like checking policy details and searching for providers. They do this by analyzing user information to suggest the right plan and subsidies.

Easier Access to Providers

A common problem that policyholders and non-policyholders face is finding the right doctor. The former generally look for one in a provider directory, which takes time. They also need to look at different places depending on the type of plan they own.

For instance, those with a Point of Service or a Health Maintenance Organization plan need a referral from their primary care doctor first if they want to take the advice of a specialist. In this case, they need to look for primary care doctors.

On the other hand, patients with a Preferred Provider Organization or an Exclusive Provider Organization can go straight to a specialist, provided their insurance covers the visit. A medical insurance app built using experienced healthcare mobile app development services can shorten the search in both cases through a well-designed search mechanism.

Speedy Claims Processing

Processing health insurance claims can get difficult depending on the nature of the medical services. The claims must comply with many federal and state regulations otherwise, they can be denied or delayed. Healthcare providers often need advanced systems designed by medical app development services to manage them, which is where such mobile health insurance apps come in.

These make claims easier to complete with the help of technologies like Optical Character Recognition (OCR). Submission and processing are faster, resulting in greater efficiency that also improves customer trust. Users are more likely to stay loyal, even encouraging people in their circles to use the app.

Data Security and Privacy

Security threats are increasing due to the efforts made by healthcare practices to transition to digital formats. Healthcare breach costs millions of dollars annually. Outside threats are also on the hunt for vulnerable targets in the form of providers that lack secure, frequently maintained software.

Investing in health insurance software development helps overcome these issues. It involves adopting a digital format with strict security measures like advanced encryption techniques to protect patient privacy while maintaining HIPAA compliance. Choose a solution designed by a medical app development company that allows you to monitor use and adjust access controls to prevent unauthorized users.

Wearable Device Integration

These apps offer a holistic approach to healthcare management when they are combined with fitness trackers and smartwatches. Health-monitoring gadgets like these provide real-time data by tracking various metrics, including heart rate and sleep patterns.

Insurers can use this information to reward users who achieve healthy tasks. They can personalize wellness programs based on every individual’s health data, encouraging users to live healthier lifestyles and lower their healthcare expenses.

Wearables can also draw attention towards irregular heart rhythms or abnormal changes in activity patterns early on. This allows health insurance apps to alert users and insurers to take preventive measures and lower the risk of serious illnesses.

Top Features Health Insurance Apps Cannot Do Without

There are certain features essential from the perspectives of the three types of users – patients, healthcare providers, and health insurance companies. The app needs to provide excellent medical service to patients, enabling them to control their insurance policies with ease. Interactions between patients and doctors must also be smooth due to this app.

User-Friendly Interface

A user-friendly interface needs to be built after a thorough understanding of how people would go about it once they download the app. Keeping the language simple is important because the average user may not be familiar with medical or insurance jargon. App functionalities that are clearly visible in a pleasing design will add to a positive experience, since 92% of app users pay direct attention to the UI/UX of the app. An experienced on-demand app development company can help you accomplish that because it knows what will appeal to the users.

Policy Management

This feature allows users to access and manage insurance policies. They can be informed of insights or changes in real time when they use the healthcare app solution, especially regarding renewals or coverage adjustments.

The app’s interface can lead users directly to the “My Policies” section for updates in this regard. It is a crucial component of health and life insurance services, as it gives policyholders control and awareness of the facilities they are entitled to. This is something over 80 percent of users want when they expect good policy management experiences in mobile apps.

Claims Submission and Tracking

A health insurance application must offer a section dedicated to claims and real-time status tracking. Patients will be able to submit claims easily after they receive medical services and be notified about the progress straightaway.

The goal is to reduce processing times and make claim handling more efficient. This will improve transparency and lead to greater user satisfaction.

Digital ID Cards

Customers prefer digital ID, which is why there has been increasing acceptance of digital alternatives in insurance and other fields. This function, therefore, is important, as it displays the insurance ID cards within the app.

Users will not have to carry physical copies with them at all times, nor will they have to worry about losing their cards. They simply have to open the app during medical visits or emergencies and show the virtual ID for instant access to any information they might need.

Having this feature added by a reliable healthcare app development agency increases convenience by making data more accessible. It also reduces reliance on physical documentation, allowing users to download and store digital ID cards directly within the app.

Provider Network Directory

Patients need health insurance app features that help them find suitable healthcare providers within the insurance network. This is possible through a searchable list of professionals or facilities in the form of a search function based on location or specialty.

It may have more filters like patient reviews to shorten the search and cater to people’s increasing reliance on online reviews to evaluate service providers. Users can make more informed decisions and get the maximum benefits from their plans through this feature.

Telemedicine

Virtual visits have increased by over 15 times due to the growing acceptance and adoption of telemedicine. Patients do not have to depend on in-person visits for non-emergency medical advice due to this feature.

This is why healthcare insurance apps need a feature that allows users to schedule and conduct virtual consultations between doctor and patient. It enables healthcare providers to reach more people in need of their services, particularly in remote areas or even urgent situations.

Appointment Scheduling

This is also an important feature as it enables users to handle their healthcare through timely services or screenings. They can find the available time slots and confirm appointments through the app, saving the time and energy needed to do so in person at a facility. Wait times also get reduced while patients have better access to healthcare services.

Health Data Tracking

If you have decided to integrate your app into wearables, you need a feature that allows it. It is a highly recommended step because of the growing trend of tracking health data through wearables, with the market reaching $87.3 billion by 2025.

The ability to collect and transmit health information should be continuous to analyze real-time health data. It gives insurers a comprehensive view of policyholder health and promotes personalized services. Users only have to link their devices to the app and grant permission for data sharing – the app will be programmed to handle the rest.

Secure Communication

The app should allow messaging between users and insurance providers whenever they have issues or need to discuss details related to a policy or claims. The channels you provide in your health insurance app development solutions need to be secure since they will involve an exchange of sensitive data.

This will contribute greatly to customer service by encouraging communication and issue resolution within the app. Users will be able to trust insurers and rest assured their information stays private.

Educational Resources

A wonderful way of building credibility while increasing healthcare awareness is by offering informative content on various topics as part of a health benefits app. Two-thirds of consumers believe providers should offer it, which is why it is actually important to include it in custom healthcare app development today.

Anytime access for users in search of health-related information will make your app a reliable source of knowledge. It will help people adopt preventive care and make better decisions regarding their health.

What the Average Health Insurance App Development Process Involves

Healthcare app development is a crucial aspect that needs proper structuring and frequent iterations to churn out a dependable final product. Therefore, it is broken down into several steps.

Project Planning

Identifying the biggest problems patients and providers face will bring you one step closer to solving them with your app. The project scope, objectives, and resources are determined in this initial phase. This is necessary because everything needs to be defined clearly before actual development starts. This sets the foundation for a successful project by bringing product goals in line with business objectives.

The more thorough you are in this step, the lower the risk of delays or miscommunication since the project timelines and resource allocation are more effective.

Market Research

Researchers collect and analyze all the information related to the target market and user needs in the initial stages of healthcare app development services as well. Understanding the competition is also vital, as it will help identify gaps and opportunities in the market – and what the average customer expects. This will bring your attention to the features that the target audience is looking for, incorporating them for app success.

Design

Next, the design team will create design prototypes based on the features finalized from market research and project planning. They will be essential in visualizing app structure and layout, defining the user interface through carefully-charted workflow and navigation in their wireframes.

Stakeholders then pitch in through feedback on how the app looks and feels. Doing this before development lowers the chance of having to make large design changes in the later stages. This will be complex and expensive.

Development

The stage is set for the actual coding and implementation of the app after design approval. Developers write code to turn design concepts into functional apps, integrating features and sticking to specifications. They work together with designers for a smooth transition from layout to development, making sure the final app meets expectations.

Testing

The testing team steps into the health insurance app development process once the initial development phase is complete. They perform rigorous testing to determine and fix issues. Their tasks also involve the improvement of app functionality and performance. Various tests help check every aspect of the app, like usability and security. An unignorable step of the process, it contributes to a great user experience by preventing post-launch bugs.

Deployment

Launching the app for public use is only done after testing is complete and with client approval. This is when the app is made available to users by deploying it to the targeted app stores and markets. Care should be taken in this step to keep downtime to a minimum if you want to make sure the product works smoothly in a live environment.

Compliance with Regulations

This is a phase that continues throughout development and post-launch. It involves constant checks to ensure adherence to relevant health and data protection regulations. This is important to mitigate legal risks and handle user data in an ethical manner.

Developers and legal experts work together to stay updated on industry regulations like HIPAA (Health Insurance Portability and Accountability Act). This way, they can protect user privacy and data security.

How Much Health Insurance App Development Costs

The exact cost of such an investment will depend on each of several factors. This is why you need to be wary if you receive a single figure without ample consultation.

Project Scope and Complexity

Development costs will increase if the app is more complex or needs features that take more time to code. Based on this, the app can cost from $30,000 to $150,000 or more.

Platform Selection

It is simple – building a native app will require coding for each platform separately, so it will cost more since you need dedicated Android or iOS app development services.

Going cross-platform is a good option if the budget will not allow but you still want to target multiple platforms. It will cost more than a single native medical insurance app development. However, the overall expenses will decrease compared to building for one market and later deciding to expand.

Native iOS or Android app development services will set you back by about $50,000 to $200,000, whereas the normal cross-platform app development cost typically falls around $60,000 to $120,000.

iOS app development servicesiOS app development servicesDesign

The average design expense does not exceed the $10,000 to $50,000 range, no matter how complicated the requirement is. Keeping this in mind, you may want to invest in high quality and level of detail because users notice everything these days.

Functionality

Features like telemedicine and wearables support will add to development costs. AI-driven insights are likely to be an inevitable addition that will not come cheap, either. Factoring around $20,000 to $90,000 to the overall insurance app development cost is a good idea.

Development

The location of the mobile app development company is a crucial factor because labor costs are different in each part of the world. If you hire a company in the US, it will be more expensive, if more reliable, than somewhere the rates are generally lower.

Testing

The app needs to be reliable, which means it requires strict testing efforts. This will contribute to the costs, about 10 to 15%, based on the extent to which it is mandatory.

Deployment

Deployment takes about 5% of the overall expenses. The more efficient the deployment strategy, the lower the downtime. Transition is that much smoother, so the money you spend here will indirectly improve user satisfaction.

Time to Choose Someone You Can Depend on

This was the beginners’ guide that included the benefits, features, and costs of building health insurance applications. While the information here is carefully researched, it is not a complete substitute for expert guidance. If you have taken the time to go through these details, we would recommend getting in touch with the health insurance app development company responsible for building health insurance apps that were market successes.