Table of Contents

As markets are going digital, so are our payment methods. Smartphones have taken over the jobs of our physical wallets, letting us pay directly through apps that serve as mobile wallets.

Mobile wallets have, in fact, completely changed how we handle money today. The adoption of mobile wallets is increasing worldwide as it benefits users in multiple ways. For instance, faster checkout via contactless payment, rewards for purchases, and seamless transactions. These mobile wallet apps have opened several opportunities for entities like banking corporations and financial companies. They offer a means to provide innovative, secure features capable of improving customer experience.

It is estimated that by 2025, there will be nearly 4.8 billion mobile payment transactions. Thus, digital wallets will take over the online world.

Businesses thinking of adopting them for better business growth need to know as much as possible about digital wallet app development before forming a strategy. Building a digital wallet app with the right information and research will help your company stand out in the best way possible.

What is a Digital Wallet App?

Digital wallet apps, also known as ‘eWallets,’ allow users to make payments using their smartphones. These are accessible on Android and iOS operating systems. Digital wallet apps, like Apple Pay or Google Pay, store the credit/debit card details to process the payment.

Digital wallet apps are the new generation’s payment mode that delivers an excellent user experience by introducing a smooth transaction method. There are at least four essential advantages that show how indispensable they have become in our lives today.

Bill Payment Options

The purpose of a digital wallet is the payment functionality between wallets and bank-to-bank.

- Users enter their credit/debit card details and make a payment securely.

- Digital wallets also enable users to pay their electricity or water bills.

- The split bill feature is also a useful addition when sharing expenses.

Rewards and Coupons

You (as a business owner) can expand customer loyalty by adding gratifying features to your digital wallet app. Users are drawn toward assured gifts and discounts, so adding incentives like cash back and reward points goes a long way.

Financial Guidance

Such apps have another useful functionality, and that is financial guidance. This includes salary deposits, bonus payments, transactional capabilities, loyalty, and reward programs. The feature also helps access information related to retirement and section 401(k) plans through gamified guidance.

Budgeting and Planning

Digital wallets often have a budgeting and planning feature for users to observe their overall savings and expenditures. These help track expenses, maintain a monthly budget and allow users to save money. It showcases all the categories where the user is spending money, like entertainment, traveling, food, or recharge.

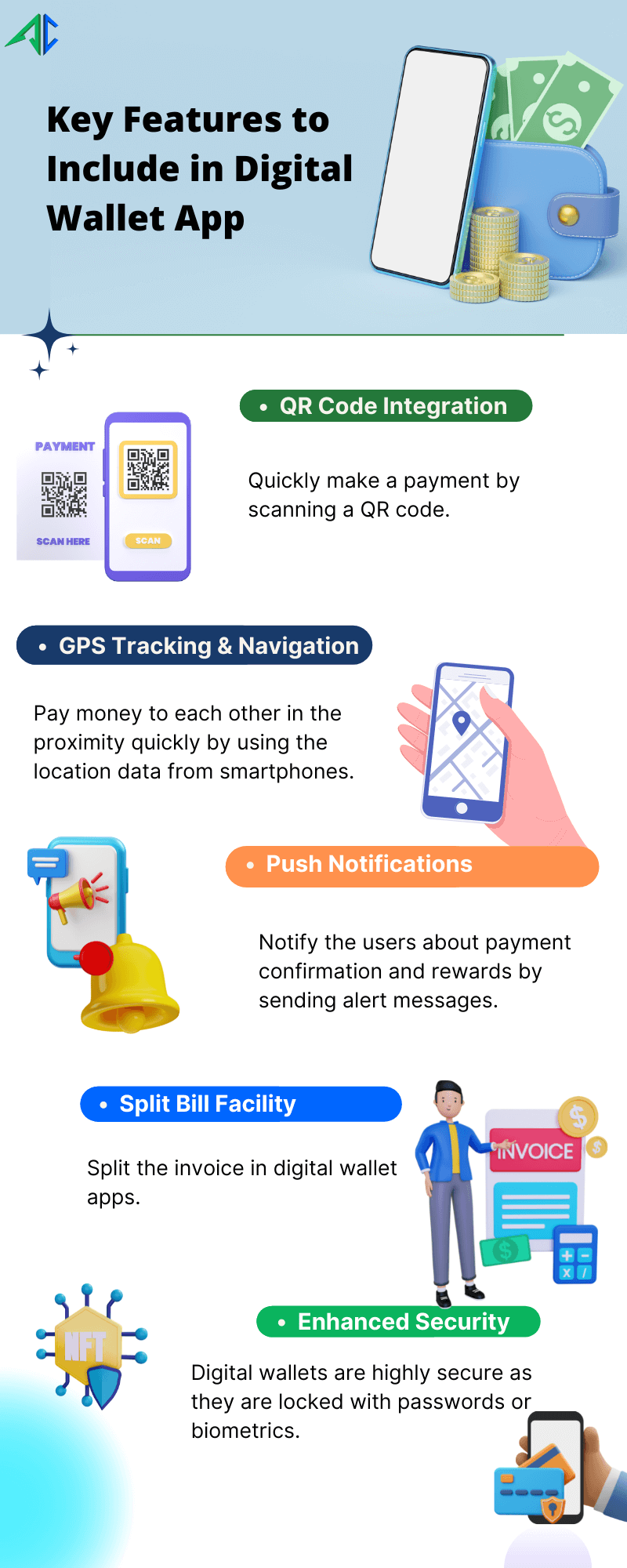

Features of a Mobile Wallet App

Apps like these are integrated with a host of user, merchant, and admin panel functionalities to carry out financial services smoothly. It is important to make note of them to maintain clarity before approaching an MVP development company to proceed with the project.

User Panel

This section shows all the user-related activities, like profiles, notifications, and settings.

- Signup via the email address or phone number

- Add authorized bank account

- Verification option via pin, pattern, and Face ID

- QR code scanner

- Transfer money or pay bills

- Check account balance

- View transaction history

- Language selection

- Chat support

- Notifications

Merchant Panel

This helps manage products, maintain order lists, offer discounts, customer interaction, etc. These are all necessary to ensure the smooth functioning of the wallet, and the corresponding features contribute to the overall mobile wallet app development cost.

- Log in to an interactive dashboard

- Add/manage products

- Verification option via pin, pattern, and Face ID

- Manage customers

- Add promotional offers & discounts

- Offer loyalty points and rewards

- Manage staff and employees

- Push notifications

Admin Panel

It is incorporated with several features that benefit the admin to manage customers and merchants. An experienced digital wallet app development agency can help integrate them seamlessly.

- Secure login to an interactive dashboard

- Generate QR code

- Manage users & merchants

- Real-time analytics

- Focus on maintaining app security

- Reporting & auditing

Types of Digital Wallet App Solutions

The types of apps available today are impressive, from open mobile wallets to closed cryptocurrency ones, embracing the decentralized future.

Closed Wallet

Companies develop them for a targeted audience to sell products. The individual is entitled to use it only with the wallet issuer for any transaction. This benefits online retailers, franchises, eCommerce service providers, independent sales, or multi-tier organizations.

One of the well-known coffeehouse chains ‘Starbucks’ also leverages digital wallet app features. Starbucks is the second player in digital wallet apps, with 31.2 million users.

Key Features of Closed Wallet:

- Caters limited customers

- In case of transaction cancellation, the entire amount is stored in the wallet.

Semi-Closed Wallet

This is another type that lets users make payments at the listed merchants or stores, keeping user data safe in one place.

A semi-closed wallet is easy to use, as it adds multiple addresses and simultaneously keeps information confidential. Apple Pay and Venmo are two great examples.

Key Features of Semi-Closed Wallet:

- Facilitates smooth transactions and seamless refunds

- Users can send money to another recipient in the same wallet network.

Open Wallet

These digital wallets work with banks to manage payments and allow fast transfers to diverse stores. However, it requires both parties (the sender and the receiver) on the same application or in any other digital wallet medium. Therefore, you have to pay attention to this feature if you opt to invest in mobile wallet app development. One of the widely-known examples of this type of application is PayPal, which delivers an excellent user experience.

Key Features of Open Wallet:

- These are used directly in a third-party application

- Customers can send and receive money through peer-to-peer (P2P) transactions

- They offer the creation of virtual cards for website and online store payments.

Why Fintech Startups are Building E-wallet Apps

Technology advancement has given rise to digital wallet app creation, and it is not stopping any time soon. From Apple Pay to Google Pay and PayPal, everyone is leveraging the features of a digital wallet. The significant reason that has boosted the digital wallet sector is the convenient checkout process.

These let users buy any product or service from their smartphones in a few taps. Most importantly, they have fewer fraud risks as they secure user payment information by adding features like face ID or setting strong passwords. A no-obligation consultation from our team will give you more details about these and the mobile app development cost associated with each.

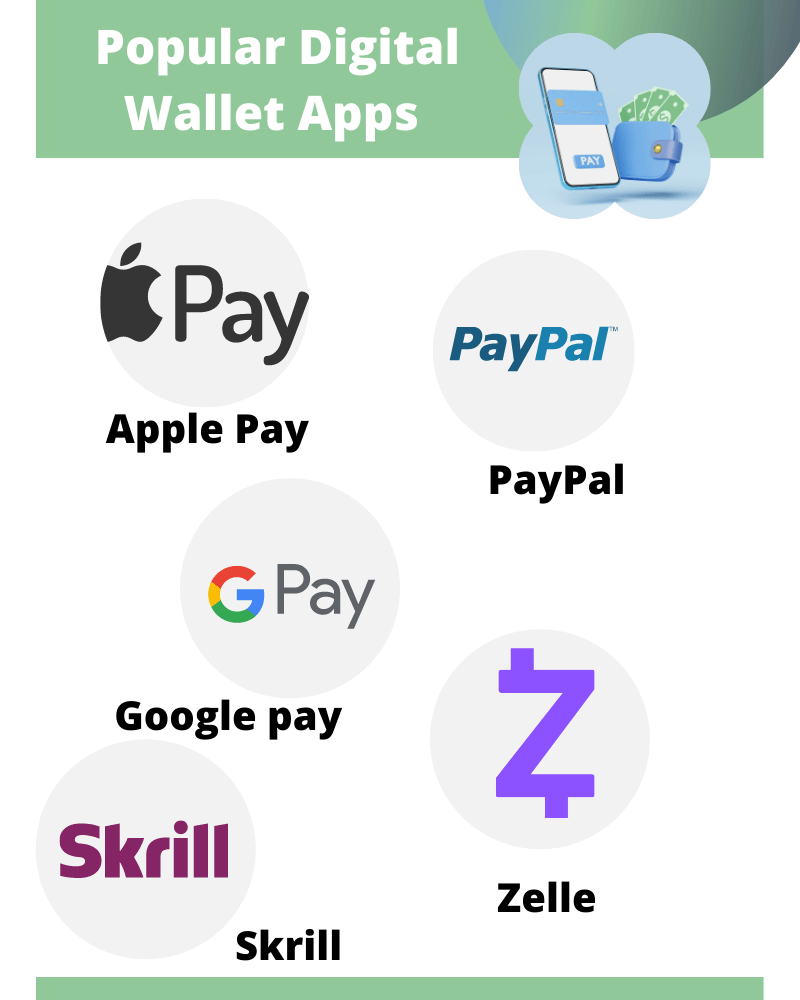

Five Popular Digital Wallet Apps for Online Transaction

Digital wallets are growing rapidly as banks and eCommerce companies have begun integrating them into their portals and apps. Many have emerged as popular payment modes on a global scale.

Apple Pay

One of the popular digital wallet apps is Apple Pay, established by Apple. It lets iOS users make a contactless payment. It is supported by Visa, MasterCard, American Express, and Apple Card. Key features include –

- It is in-built – This app is by default present in Apple devices, like iPhone, Apple Watch, Mac, and iPad.

- Uses Apple Cash – Apple Pay supports Apple Cash, which works like a debit card. It lets users send or receive money right in messages by setting up the card in the Wallet app.

- User purchases stay private – Apple Pay does not collect any transaction data while paying with a credit or debit card. While using Apple Cash, the information is stored for troubleshooting, fraud prevention, and regulatory purposes.

Google Pay

The tech giant launched its digital wallet as a fast and simple way to shop online or in stores, and it is integrated with products like Gmail.

It is a semi-closed wallet app that uses NFC technology for easy payment processing. Users can receive or send money by simply linking the bank account or setting up the UPI pin. It has many features that have made it a useful addition to smartphones.

- Fraud alerts while sending money – Google Pay sends fraud alerts while making payments to someone not on the contact list using machine learning. It identifies phishing or any other fraud risk while sending or receiving money.

- Only users can pay with their phone – The app needs authentication via pattern, pin, or biometric to open before you can make a payment. This is an important feature that will add to your app’s credibility, although it will affect the final e-wallet app development cost if you decide to include it.

- Easy-to-use privacy controls – Users have the option to use the transaction history with GPay for a better user experience within the app or not.

PayPal

This essential digital wallet app for Android and iOS lets users transfer funds or make online payments. It has many features that help keep accounts secure, making it extremely safe and reliable. These include end-to-end data encryption and email confirmation for transactions.

- Protection for your account and purchases – Users do not have to share their complete financial information as it is secured using data encryption during every transaction.

- Get paid on an online marketplace – Entrepreneurs can sell their products on a different platform and track their PayPal transactions in one place.

Zelle

Zelle lets users send money easily between US bank accounts within a few minutes. Enter your email address or phone number, and get ready to send or receive money as quickly as possible with excellent security.

- Use Zelle with friends at other banks – It is functional across over 2000 banking apps at present, which means you can safely send and receive money to a different bank.

- Free to use for family or friends – While sending money to their family or friends, it will not charge extra money for transactions. This is one of its key features, the popularity of which can be credited to the digital wallet application development firm that built it.

Skrill

This is another well-known digital wallet provider that offers money transfer services for many purposes. Whether a user wants to spend on trading or gaming, it manages their payments effortlessly.

- Multiple options – Users can make payments from over 100 local methods for easier cross-selling across borders.

- One-touch payments – Skrill offers a frictionless checkout process and delivers a better user experience. It allows repeat transactions with a single touch.

Step-By-Step Guide for Digital Wallet App Development Process

Knowledge of the steps that constitute the digital wallet app development process is crucial to ensure your product meets market requirements.

Discovery Stage

Begin the digital wallet app development for startups by discovering your ideas, vision, purpose, and goals. In this stage, you can visualize as many app ideas as you want.

Define all the essential requirements to conceptualize the best version of your app. Ask and answer relevant questions, like what your expectations are from the final app and what niche you intend to serve, if any. Decide the technology stack and budget for the entire mobile app development and launch process as well. Identify the technical prerequisites once you select the most feasible options and match market availability.

Conduct Market Research

In the next stage, conduct market research in order to get familiar with your targeted audience’s preferences and know what your competitors are up for. You can conduct market research by preparing questionnaires and surveys.

With the help of market research, business owners get better ideas on how to strengthen their market position or what are the emerging trends. Lastly, with the help of market research, entrepreneurs gain insights into services offered by competitors in order to stay ahead of the curve.

Custom UI/UX Design

The user interface effectively impacts the targeted users, so make it count. Try to make the app’s UI feature-rich, user-friendly, and aesthetically pleasing to attract your intended audience. Also, create an app prototyping to validate the app design and get an advanced overview of your app.

Start Digital Wallet App Development

After finalizing the design, the coding process finally begins. Here, app developers start converting UI mockups into a fully functional digital wallet. They integrate all the necessary features and customizations to deliver a better user experience.

Once the mobile app development stage is over, conduct quality assurance (QA) testing to identify any errors or issues in the app that might intervene in the digital wallet app’s further use.

App Launch & Promotion

Your app is ready to get released on popular app stores. The digital wallet app company in charge of your project will launch the app on the platform of your choice. This task will also involve creating an account with the relevant app title, screenshots, informative descriptions, and keywords. As a business owner, you can begin to think about marketing strategies and mobile app maintenance costs long before the app is released.

What Is the Cost of a Digital Wallet App Development?

The cost of digital wallet app development services depends on numerous factors.

- Platforms on which the app will be developed

- App design and size

- Hosting and security

- App testing

- Mobile app maintenance costs

Final Thoughts

Digital wallets like Apple Pay and Google Pay are already popular, and these will soon become the most used payment methods.

Now that you are aware of the basics concerning eWallets consider hiring a digital wallet app development company like AppsChopper to build yours. You are bound to get a high-performing app for better business growth with our talented and experienced team of consultants and designers. We can help formulate and build the app with competitive research and essential functionality to establish and strengthen your market presence.