Table of Contents

The chronology of payment apps like Cash app is embedded in the more comprehensive expansion of digital transactions. Since the idea of P2P payments has existed throughout generations, the modern normalization of P2P payments can be traced back to the 2000s. The peak of P2P payment app development is connected to the invention and wide usage of PayPal, founded in 1998 by Peter Thiel, Max Levchin, and Luke Nosek. It was envisioned as a medium for protected and online payments. By eliminating manual paperwork banking, PayPal later offered a step forward in how people and businesses of all sizes could transact over the Internet.

A demand for a dependable and layman-friendly strategy to transfer money with electronic devices at home enriched the paths towards thriving in the economy. In the mid-2000s, P2P payment apps like Cash App, previously known as Square Cash, Venmo, and Zelle, started to transform the transaction environment, facilitating users’ transfer or receipt of money through mobile apps. These payment applications are offered to a generation of customers who appreciate comfort and accessibility. As an outcome, P2P payment apps turned into part of the financial toolkit, facilitating tasks like splitting money between friends.

P2P payment apps continue to grow by incorporating new features like international money transfers and biometric or face-recognition authentication. With P2P payments at the forefront of digital finance transformation, they are to persist in playing an essential role in the future of personal finance.

Market Overview of P2P Payment Apps Like Cash App

The value of contactless payment transactions is anticipated to surpass $10 trillion USD by 2027 as per the report by Business Wire. The international fintech market is also predicted to attain $211.64 billion USD by 2027. The statistics represent a wave in the usage of financial technology and money transfer apps and how they enable us to manage finances with P2P payment apps like Cash App.

The market value and global standings of peer-to-peer payment apps made a case for their popularity and future expansion. One main question that might cross decision-makers’ minds is the cost of developing a money transfer app.

Factors Affecting the Cash App Development Cost

The cost of building a P2P payment app begins at $25,000 USD, with all the basic features and functionalities compared to advanced apps. Nevertheless, the mobile app development cost depends on elements like app complexity, features to be incorporated, the team you plan to hire, and the location of the FinTech application development company.

-

P2P Payment App Development Platform

The cost to build a P2P payment app ranges depending on the distinctive platform businesses and enterprises select, as each has its own development strategy and technological conditions. Here is a table of the costs of iOS or Android app development and cross-platform app development with basic features to help you understand.

| Development Platform (Simple App) | Duration | P2P Payment App Development Cost |

| iOS App Development | 1000-1400 hours | $45,000 to $100,000 |

| Android App Development | 900-1300 hours | $40,000 to $90,000 |

| Cross Platform Development | 1100-1500 hours | $25,000 to $45,000 |

The platform you finalize can influence the P2P payment app development cost, so it is essential to take the time to assess your choices and create the most suitable alternative for your distinct requirements and objectives.

-

Fintech App Based on UI/UX Design

Indeed, the UI/UX design is one of the most noteworthy elements of any mobile app that targets a lay audience. A systematically designed app will not only impress the audience but also make it comfortable to operate and navigate. Concerning fintech app development solutions, the design should be accessible and straightforward so that users can effortlessly comprehend and utilize its different elements.

The cost to develop an app like Cash app depends on the intricacy of the design and the number of screens that ought to be constructed. The table below explains the timeline for the phases of app design.

| Designing Stage | Duration |

| Planning and Analysis | 1-2 weeks |

| Wireframing and Prototyping | 2-3 weeks |

| Low-Fidelity Wireframe | 1-2 weeks |

| High-Fidelity Wireframe | 3 weeks |

| App Designing | 2-3 weeks |

| Prototype | 4-5 weeks |

-

P2P Payment App Development Cost Based on Features

The foundation for developing a P2P payment app is its features and functionalities. Your software will be more beneficial to users if you guarantee the essential functionality. Any P2P payment app should provide its customers with the functionality it presents.

Therefore, what features do you require to create an app like Cash? We have enlisted a few essential features to assist you in making your app more dependable and worthwhile. These features also influence the comprehensive cost of apps like Cash.

| Features of Custom Payment App Development | Development Duration |

| Splits Payment | 50-70 hours |

| Mobile Wallet | 90-120 hours |

| Payment Requests | 70-100 hours |

| In-App Messaging | 90-110 hours |

| Two Factor Authentication | 15-30 hours |

| Credit Card Support | 90-100 hours |

| Payment Reminders | 35-60 hours |

| International Payments | 80-100 hours |

| Admin Panel | 100-140 hours |

| Third-Party Integration | 110-130 hours |

-

Cost of Apps Like Cash Based on Hiring Approach

The P2P payment app development cost will also depend on the team of professionals you work with. If you hire app developers or outsource for fintech application development services, they can guarantee a payment app within budget. Regardless, if you select to operate with a freelancer or a less professional development team, the Cash app development costs may be more than expected.

| Hiring Model | P2P App Development Cost |

| Freelancers | $35,000 |

| In-House | $85,000 |

| App Development Company | $60,000 |

-

Payment App Development Cost Based on Location

The location of the digital wallet app development company can also influence the cost of building a money transfer app. If you decide to operate with a development team based in North America or Australia, you can anticipate paying higher rates than functioning with a development team based in South America. The locations of the teams in North America and Europe manage to have more increased overhead expenses. When compared to locations like India, these places have inflated economies.

The table below will provide you with the average P2P payment app development cost on a per-hour basis.

| Location | Cost (Per Hour) |

| North America | $160 per hour |

| Australia | $80 per hour |

| UK | $80 per hour |

| South America | $55 per hour |

| Central Europe | $45 per hour |

The pointers mentioned above are some essential elements that will influence the cost of building a P2P payment app. When thinking about the budget, it is necessary to recognize that the P2P payment app development costs are just a tiny component of the prevailing equation.

P2P Payment App Development Cost Breakdown

The mobile app development cost for apps like Cash App might start from $25,000 USD and range up to $150,000 USD, depending on the features needed. The Cash App was built with a native development procedure, which suggests they chose platform-specific help for app development, leading to higher costs.

Regardless, if you build the app utilizing a cross-platform method, the expenditure will be low and be cost-effective for businesses and enterprises. Therefore, it is more suitable to define your necessities and then obtain an accurate cost estimation.

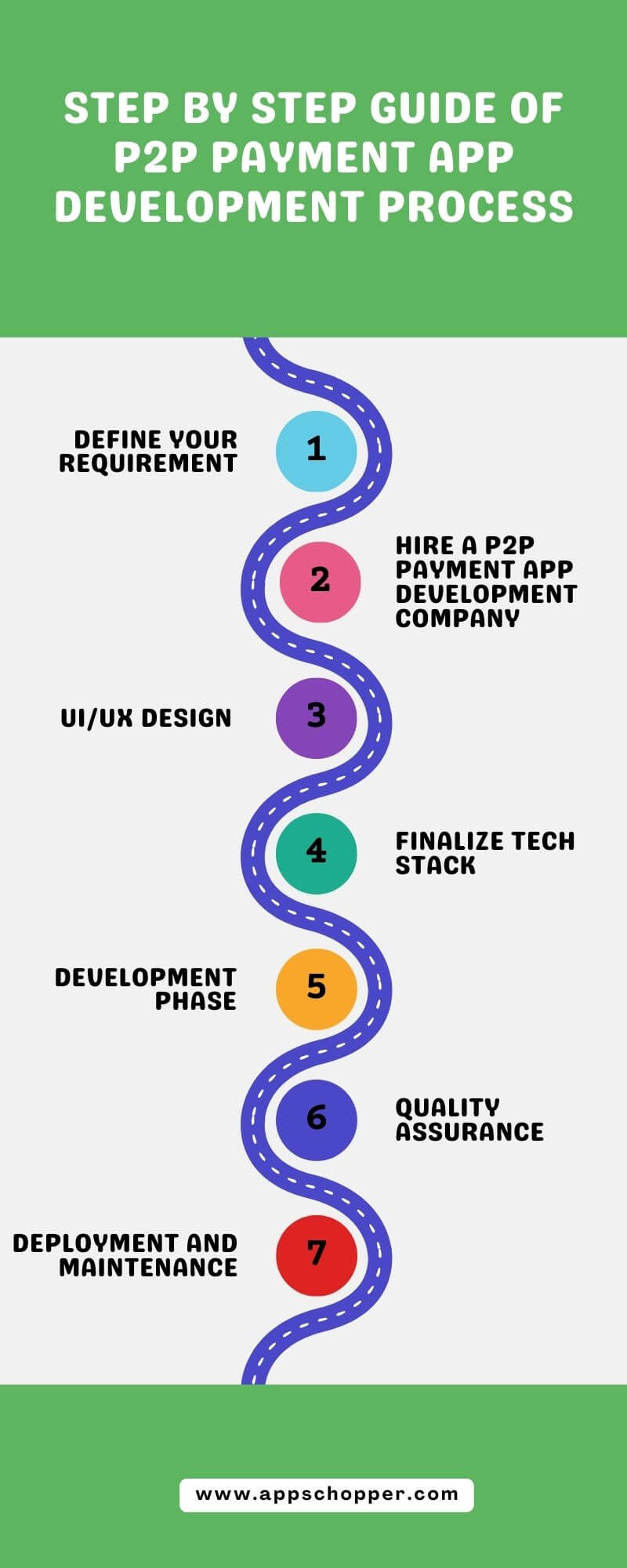

Step By Step Guide of P2P Payment App Development Process

P2P payment app development process

Moving on to the mobile app development process, businesses and enterprises must focus on a few steps that ensure that high-functioning payment apps offer users immense experience. Let us learn the step-by-step process of building payment apps like Cash.

-

Define Your Requirement

Before reaching out to a company for assistance in building a payment app like Cash and Venmo, decision-makers must finalize the features and functionalities of their app idea. They must ask themselves a few questions and draw an outline of things they need from their app.

Who is the target audience?

What are the features that they need?

What are additional functionalities of the app that can engage the audience?

Once you have answers to these questions, you can move ahead with the next step.

-

Hire a P2P Payment App Development Company

Choosing a suitable P2P payment app development company can be daunting, and for that, you must go through reviews and portfolios of different companies. Once you have finalized the company that aligns with the idea, make them understand your payment app idea and all the features that you want to include in them. The company ensures to do the planning and market research and brings further planning.

-

UI/UX Design

When the app development company understands the app idea, they start with the UI/UX design planning to ensure that your app has smooth navigation, is accessible information, and is layman-friendly. The wireframing constructs the layout of the payment app.

-

Finalize Tech Stack

One essential step during the P2P payment app development process is the finalization of the tech stack. The type of platform and the audience you want to target decides the tech stack. The professionals assist you in understanding the pros and cons of iOS, Android, or cross-platform development and move ahead with the process as per your decision.

-

Development Phase

After the UI/UX and tech stack phase, the development phase begins, which is where the building of your app starts. The addition of features, inclusion of functionalities, and integration process occur. Everything from building the search bar for different payment categories to splitting the amount feature is incorporated during the development phase.

-

Quality Assurance

Soon after the development process, the quality assurance team analyzes the code base and the application to ensure they work correctly. From fixing bugs to ensuring the app’s performance, any issues the app is facing are rectified and made ready for the market.

-

Deployment and Maintenance

The last development phase is app deployment. Professionals ensure your app is ready to hit the market and available for users to make transactions without delay. Considering that the entire process sums up here, app maintenance is also one factor in keeping the app running. The maintenance and support teams ensure that the app faces no performance issues and is regularly updated according to emerging trends.

For More- Digital Wallet App Development Guide

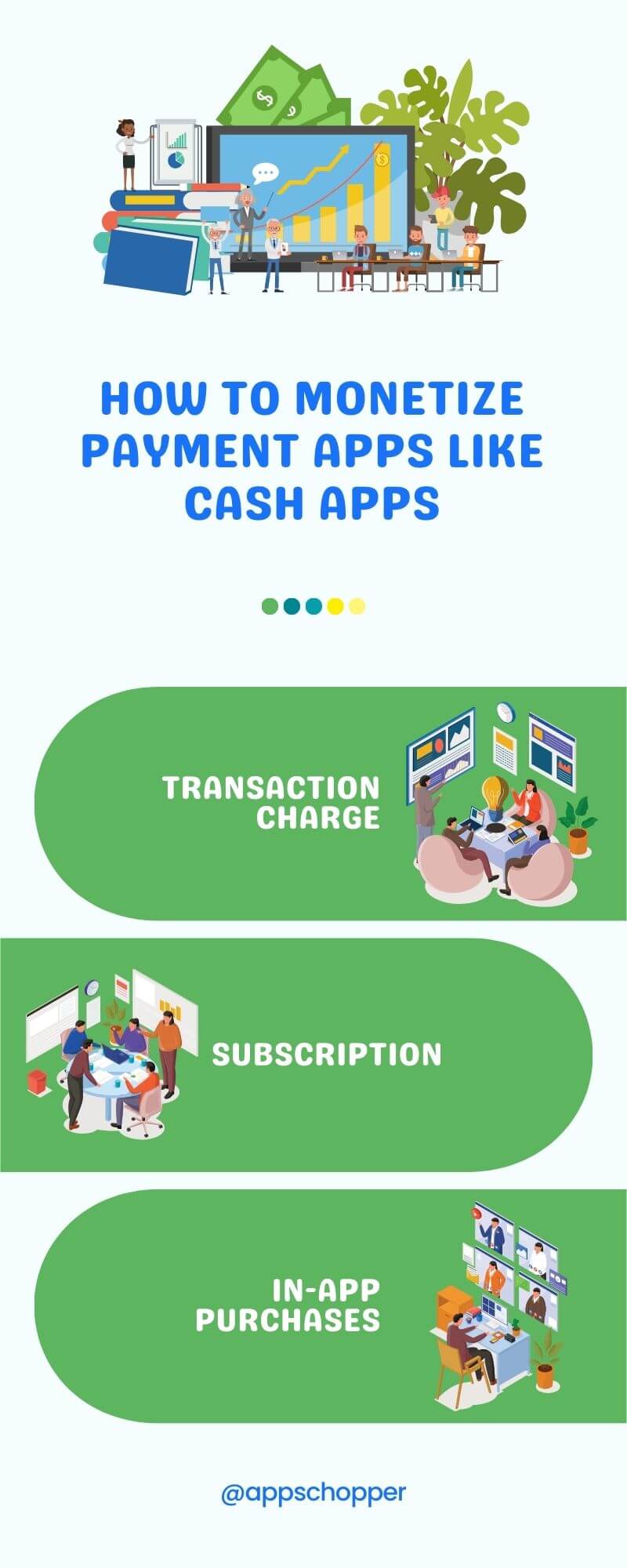

How to Monetize Payment Apps Like Cash Apps in the Business-Centric Economy?

When it comes to monetizing your payment app, there are numerous ways to do that without including features or making it freemium-based. Businesses have been profiting from monetizing their apps with different methods. Let us dive in-depth to understand the profitable aspects of payment apps.

-

Transaction Charge

The most standard practice is to charge a transaction price per money transfer utilizing the app. It can also be applied to transacting money from credit card to digital wallet.

-

Subscription

Another method to earn funds with apps like Cash app is to present premium components that can be utilized by spending a monthly or annual subscription fee.

-

In-App Purchases

Yet another method of earning funds with apps like Cash is to make in-app purchases. For instance, you can trade virtual money or tokens to transfer money or redeem coupons.

These are reasonable methods of earning money with apps like Cash, and the most sensible form to decide which standard suits your app will rely on your distinguishing purposes and objectives.

Finalize AppsChopper to Build an App like Cash

AppsChopper has a team of professionals who can assist you in creating an app similar to the Cash app. We have performed with customers globally and have provided fintech applications within a budget with our mobile app development services.

Our payment application developers ensure that their industry knowledge and technology expertise add value to their projects. They bring a cognitive tech stack and offer businesses robust P2P payment apps.